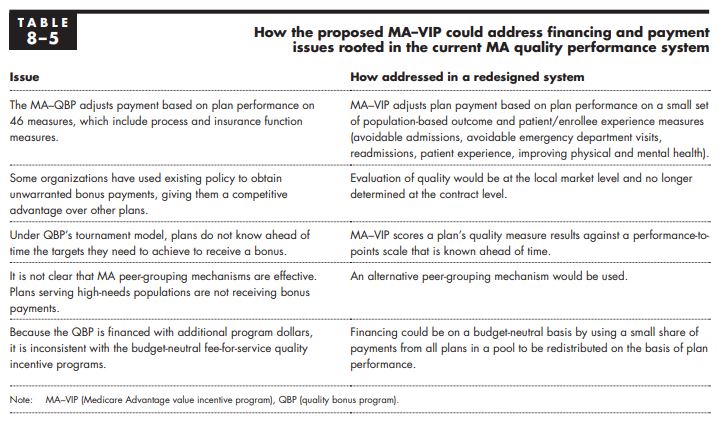

“The Medicare Advantage (MA) quality bonus program (QBP), which rewards MA plans on a quality star rating scale, is flawed and inconsistent with the Commission’s principles for quality measurement. First, the QBP includes almost 50 quality measures, including process and administrative measures, instead of focusing on a small set of population-based outcome and patient experience measures. Second, organizations are rated at the MA contract level. Contracts cover very wide areas—including noncontiguous states—and therefore a contract-level rating may not be a useful indicator of the quality of care provided in a beneficiary’s local area. Third, the QBP uses a “tournament model,” scoring plans’ performance relative to one another rather than in relation to predetermined performance targets. Under this model, performance targets depend on the relative performance of plans and are not known in advance, which makes it difficult for plans to manage their quality improvement efforts. Fourth, the QBP uses a version of peer grouping to adjust for differences in plans’ enrolled populations but does not appear to sufficiently capture variation in quality among Medicare population subgroups (such as low-income beneficiaries and beneficiaries with disabilities).

An additional issue is that, unlike nearly all of Medicare’s fee-for-service (FFS) quality incentive programs, the MA–QBP is not budget neutral but is instead financed by added program dollars. The Commission’s original conception of

a quality incentive program for MA plans was a system that would be budget neutral and financed with a small percentage of plan payments (Medicare Payment Advisory Commission 2012). A budget-neutral system is consistent with the Commission’s principle of providing a financially neutral choice between private MA plans and traditional FFS Medicare and of ensuring a level playing field between the two sectors.

In this chapter, we propose a Medicare Advantage value incentive program (MA–VIP) for assessing quality of care consistent with the Commission’s quality principles. It is intended to be patient oriented, to encourage coordination across providers and time, and to promote relevant improvement in the nature of the delivery system. An MA–VIP would use a small set of population-based outcome and patient experience measures to evaluate MA quality. The program would use clear, prospectively set performance standards to translate MA performance on these quality measures to a reward or a penalty. The MA–VIP would consider differences in plans’ enrollees by incorporating an improved peer-grouping method in which quality-based payments are distributed to plans based on their performance for population groups, such as a plan’s population of beneficiaries who are fully dual eligible for Medicare and Medicaid.

[..] Ideally, an evaluation of quality in MA would be based in part on a comparison with the quality of care in traditional FFS Medicare, including accountable care organizations, in local market areas (Medicare Payment Advisory Commission 2010). However, data sources for comparing MA with traditional FFS at the local market level are limited. Therefore, our proposed MA–VIP design does not yet include a component for FFS comparison. In the future, better encounter data from MA and expanded patient experience surveys will help enable comparisons of the two programs.

[End of Chapter Summary]

[..] Most of the outcome and patient experience measure domains we propose for an MA–VIP are existing quality measure domains and include measures the Commission has discussed in the past as a basis for comparing MA and FFS and has discussed including in a voluntary value program for groups of clinicians (Medicare Payment Advisory Commission 2018a, Medicare Payment Advisory Commission 2015). The measure domains include avoidable hospitalizations, avoidable emergency department (ED) visits, readmissions, patient experience, and patient-reported outcomes. Currently, the lack of complete MA encounter data limits the population-based measures we can include in the MA–VIP. For example, our analysis has found the post-acute care encounter data to be incomplete, so we cannot use the data to directly measure post-acute care for beneficiaries. Also, encounter data, like FFS claims data, do not include detailed clinical information such as tests performed during medical visits, discharge plans, and lab results (e.g., cholesterol levels) that could allow us to measure preventive care, coordination across providers, and clinical outcomes without a need for medical record review. [..] In the future, we can model the MA–VIP payment adjustments using measure results calculated from three data sources: (1) encounter data that MA plans submit to CMS supplemented with other administrative data sources (e.g., Medicare Provider Analysis and Review (MedPAR) hospital inpatient data); (2) beneficiary-level patient experience survey data (e.g., CAHPS); and (3) beneficiary-level patient-reported outcome survey data (i.e., the Health Outcomes Survey (HOS) results). Once MA encounter data have improved, relying on these data as the source of quality evaluations will bring greater uniformity to the comparison among MA plans and with FFS. In addition, the use of MA encounter data and FFS claims-based data would have the advantage of not introducing new reporting systems or new reporting requirements to either program.

[..] Given the evidence that [MA] bids have steadily declined in each of the quartile areas, it appears that plans have been able to harness their capacity for innovation and efficiency to the benefit of their enrollees, who have generous extra benefits at record levels. However, the Medicare program as a whole has not fully benefited from this increased efficiency because benchmarks continue to be tied to FFS expenditure levels and there is no direct payment policy, such as an MA payment update mechanism, that evaluates payment levels in relation to what constitutes an efficient plan (analogous to the Commission’s examination of efficient providers in the FFS sector).

[..] The two main takeaway points from this analysis are that, between 2018 and 2019, when plans received extra money in the form of a boost in their benchmark by moving from nonbonus to bonus status, the money was not all used to provide extra benefits; in fact, most of it was not used for that purpose. The other takeaway point is that when plans lose their bonus status and have less money coming from the Medicare program, they reduce their bid, or stated cost, for providing the Medicare Part A and Part B benefit. That is, you could say that they react to financial pressure by becoming more efficient—behavior that is consistent with the behavior of efficient providers in FFS Medicare when financial pressure is applied on Medicare’s FFS payments.”